Riyadh Emerges As A Regional Business Hub With A Jump In Foreign Firm Relocations, Driven By Strong Non-Oil Sector Growth

Riyadh’s office market continued its strong performance in Q2 2024, as per the latest Saudi commercial market report by Savills, reflecting the strength of the non-oil sector. This sector is considered a key driver of the economy, and it grew by a solid 3.4% year-on-year in the first quarter of this year, exceeding initial estimates. Continued non-oil activity is expected to propel GDP growth to a projected 5% this year.

Low inflation, which is currently at a moderate 1.6% year-on-year for a third straight month in May 2024, is another positive sign for the business environment. The Purchasing Managers’ Index (PMI) was steady in the expansionary zone at 56.4 in May, marking the 45th consecutive month above the neutral 50 mark that indicates expansion.

A surge of corporate interest is propelling Riyadh to the forefront of the region, with foreign direct investment (FDI) increasing by 5.6% year-on-year in Q1 2024 and is expected to persist throughout the rest of the year. This momentum is driven by several factors, including the strategic focus of Saudi Vision 2030 on attracting foreign capital andthe government’s investment incentives, including tax breaks, which are proving highly attractive to international corporations seeking to establish regional headquarters within the Kingdom.

This strategy has yielded positive results, with over 120 foreign firms relocating their regional headquarters to Riyadh in Q1 2024, which represents a remarkable 477% increase compared to the same period last year. This sentiment is further bolstered by the recent establishment of regional headquarters in Riyadh by prominent entities such as PayerMax and Ernst & Young. The city’s expanding market and promising economic prospects are attracting leading businesses across diverse industries, cementing Riyadh’s position as a vital hub for regional and global commerce.

Ramzi Darwish, Head of Saudi Arabia at Savills Middle East, comments:“The Kingdom’s ongoing efforts to diversify its revenue streams and create an attractive business environment are proving successful, as evidenced by the high volume of international inquiries. In the second quarter of 2024 alone, nearly 70% of inquiries received by Savills originated from outside Saudi Arabia, with a significant portion of 50% coming specifically from US and UK corporations.”

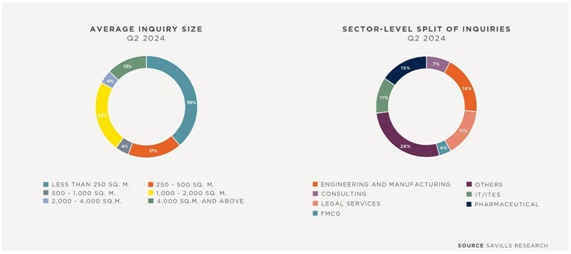

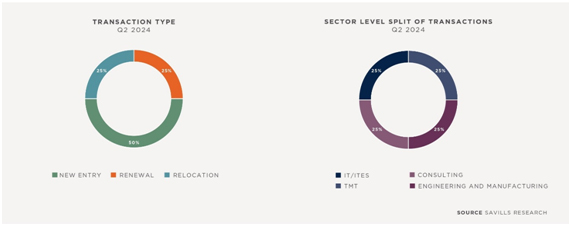

Savills observed a significant increase in leasing activity during the second quarter of 2024. This growth was driven by a variety of sectors, including Technology, Media & Telecommunications (TMT), Consulting & Engineering, Manufacturing, and IT/ITes. Notably, 50% of these completed transactions involved new entrant companies, indicating a positive market sentiment for business expansion. The momentum is expected to continue, with a robust pipeline of inquiries for the rest of the year. Engineering & Manufacturing, Legal Services, and pharmaceutical companies are at the forefront of this interest, collectively representing nearly 50% of all inquiries received by Savills. A significant portion, estimated at 60%of these inquiries, focused on office spaces under 1,000 square metres, suggesting a growing preference for agile and efficient work environments.

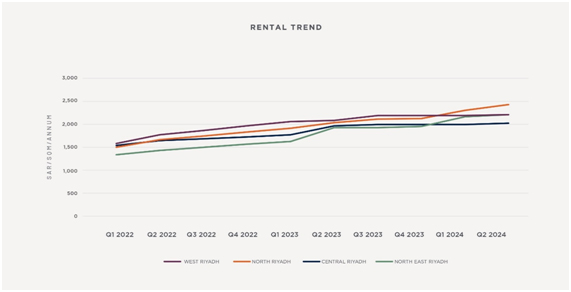

Amjad Saif, Head of Transactional Services at Savills in KSA, adds, “Limited prime office space in Riyadh, coupled with strong business confidence, has driven Grade A occupancy as high as 98%, and rents are increasing steadily, rising by 3% quarter-over-quarterin Q2 and a significant increase of 13% year-on-year.”

Some areas, like North and North-East Riyadh,have witnessed steeper rent increases, reaching 23% and 20% annual growth, respectively. This trend reflects a thriving office market in the Saudi capital. Fuelled by robust demand, however a significant increase in Grade A office space supply is anticipated by the end of 2025. This anticipated influx of over 650,000 square metres of new space is expected to enhance tenant options and mitigate the potential for a supply shortage.

Email: info@cyber-gear.com

Email: info@cyber-gear.com