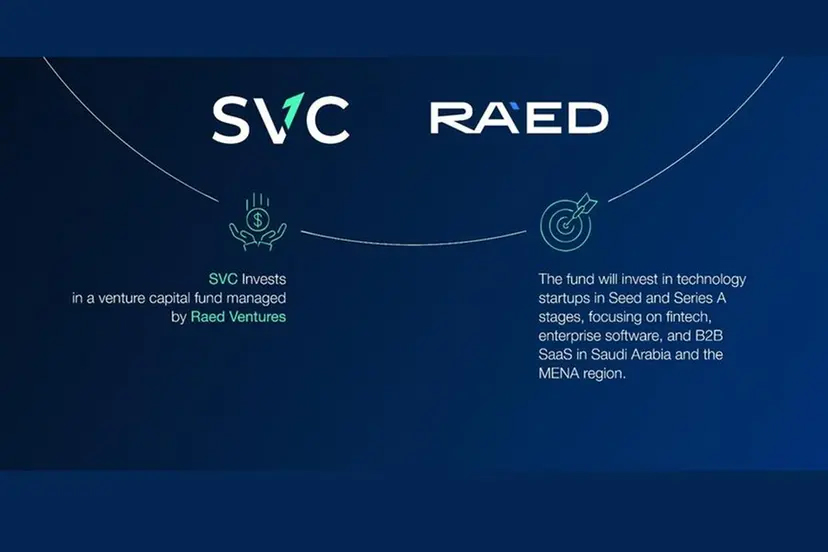

Saudi Venture Capital Invests In A Venture Capital Fund By Raed Ventures

Saudi Venture Capital (SVC) has announced an investment in Raed III L.P., an early-stage venture capital fund managed by Raed Ventures.

The fund will target tech and tech-enabled startups across Saudi Arabia and the MENA region, primarily focusing on Seed and Series A stages, emphasizing fintech, enterprise software, and B2B SaaS sectors, predominantly in Saudi Arabia and UAE markets.

Dr. Nabeel Koshak, CEO and board member at SVC, said: “Our investment in the venture capital fund managed by Raed Ventures aligns with our strategy to back private investment funds that focus on Saudi-based startups at different stages of growth. This commitment aims to accelerate the growth of these startups, diversify the national economy, and contribute to the objectives of Saudi Vision 2030.”

Omar Almajdouie, Founding Partner at Raed Ventures, commented: “We are delighted to continue our strategic partnership with SVC as an anchor investor in Raed III, building upon the success of our collaboration in Raed II. Through its commitment to empowering startups and enabling innovation, SVC has been instrumental in driving the Kingdom’s remarkable progress in this sector. Together, we aim to support the growth of promising startups and contribute to the continued development of a thriving ecosystem in Saudi Arabia and beyond.”

SVC is an investment company established in 2018. It is a subsidiary of the SME Bank, part of the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO through investment in funds and direct investment in startups and SMEs.

Email: info@cyber-gear.com

Email: info@cyber-gear.com